Understanding the Premarket US Stock Market

author:US stockS -

The premarket US stock market is a crucial component of the financial world, offering investors a unique opportunity to trade before the official market opens. This article delves into the intricacies of the premarket, its significance, and how it can impact your investment decisions.

What is the Premarket US Stock Market?

The premarket refers to the period before the official opening of the stock market. During this time, traders can buy and sell stocks, bonds, and other financial instruments. The premarket session typically begins at 4:00 AM ET and ends at 9:30 AM ET, although the exact hours may vary depending on the exchange.

The Importance of the Premarket

Early Access to Market Information: The premarket allows investors to gain early access to market-moving news and economic data. This can help them make informed decisions before the official market opens.

Trading Opportunities: The premarket provides an opportunity to trade before the market opens, allowing investors to capitalize on early price movements.

Risk Management: Traders can use the premarket to manage their risk by adjusting their positions before the market opens.

How to Trade in the Premarket

Use a Brokerage Account: To trade in the premarket, you need a brokerage account that supports premarket trading.

Access to Real-Time Data: Ensure that your brokerage account provides real-time data during the premarket session.

Stay Informed: Keep an eye on market-moving news and economic data during the premarket period.

Key Factors Affecting the Premarket

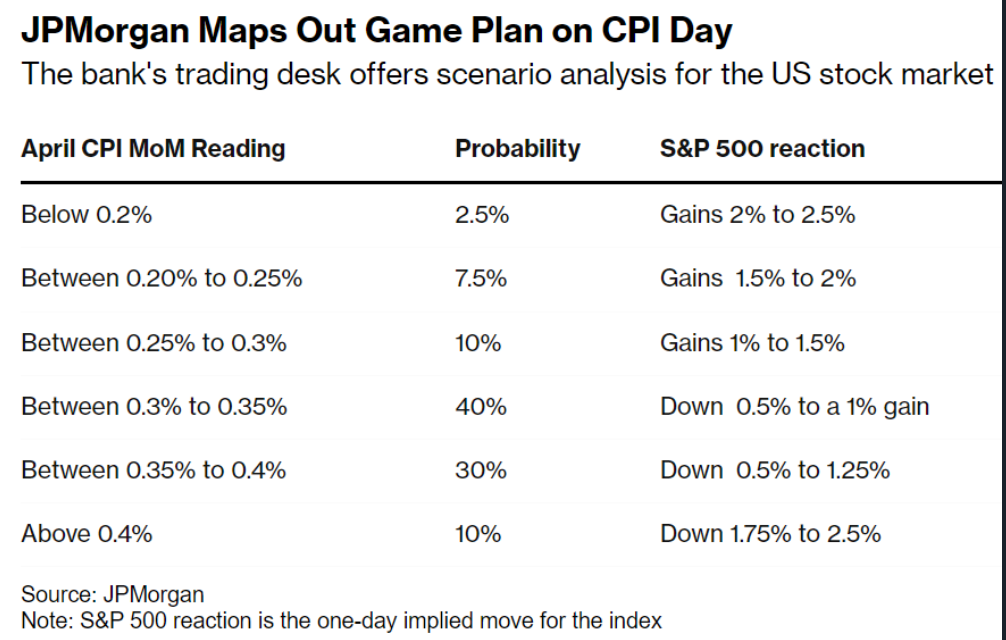

Economic Data: Economic reports, such as GDP, unemployment, and inflation, can significantly impact the premarket.

Corporate Earnings: Earnings reports from major companies can cause significant volatility in the premarket.

Market Sentiment: The overall sentiment of the market can influence the premarket, with positive news often leading to higher prices and negative news causing declines.

Case Study: The Impact of Economic Data on the Premarket

Consider a scenario where the US economy releases positive GDP data. This news can lead to a surge in demand for stocks, causing the premarket to open higher. Conversely, if the data is negative, it can lead to a sell-off in the premarket.

Conclusion

The premarket US stock market is a valuable tool for investors looking to gain an edge before the official market opens. By understanding the intricacies of the premarket and staying informed, investors can make informed decisions and potentially capitalize on early market movements.

can foreigners buy us stocks