US Stock Market Analysis: September 2025 Outlook

author:US stockS -

Introduction

As we approach September 2025, investors are keenly analyzing the US stock market to predict its trajectory. This article delves into the key factors influencing the market and provides a comprehensive analysis of what investors can expect in the upcoming months.

Economic Indicators

Inflation and Interest Rates

One of the primary factors affecting the stock market is inflation. In September 2025, the Federal Reserve is expected to continue its efforts to control inflation. As such, investors should keep a close eye on the Consumer Price Index (CPI) and Producer Price Index (PPI). Any significant changes in these indicators could have a profound impact on the stock market.

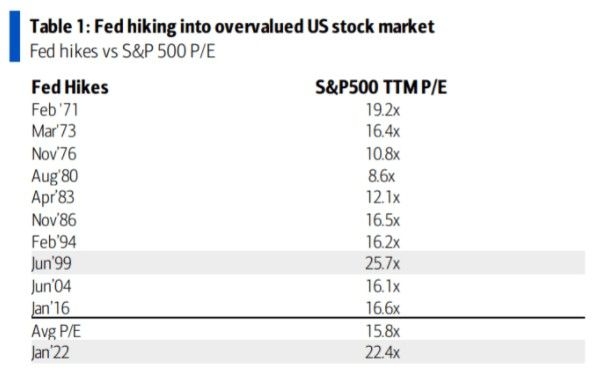

Interest rates are also a critical factor. The Federal Reserve's decisions on interest rates can significantly influence investor sentiment and market performance. With the possibility of a rate hike in the pipeline, investors should be prepared for potential volatility in the stock market.

GDP Growth

The Gross Domestic Product (GDP) growth rate is another essential economic indicator. A strong GDP growth rate suggests a healthy economy, which is generally positive for the stock market. Conversely, a weak GDP growth rate could signal potential challenges ahead.

Sector Performance

Technology

The technology sector has been a significant driver of the US stock market for several years. In September 2025, investors should pay close attention to major tech companies like Apple, Google, and Microsoft. These companies' performance can indicate the overall health of the technology sector and the broader market.

Energy

The energy sector is another crucial component of the US stock market. With the ongoing shift towards renewable energy, companies like Tesla and SolarEdge are likely to remain in focus. Additionally, the global energy market's response to geopolitical tensions and supply chain disruptions will be a key factor to consider.

Healthcare

The healthcare sector has seen significant growth in recent years, driven by advancements in technology and an aging population. Companies like Johnson & Johnson and Pfizer are likely to continue performing well. However, investors should be cautious of potential challenges, such as rising healthcare costs and increased regulation.

Market Volatility

In September 2025, the stock market is expected to experience heightened volatility. This is primarily due to the factors mentioned above, including inflation, interest rates, and economic indicators. As such, investors should adopt a diversified approach to their portfolios to mitigate risk.

Case Study: Amazon

One notable example of market volatility is Amazon. In the past, Amazon has been able to navigate economic uncertainties and continue growing. However, in September 2025, investors should be wary of potential challenges, such as increased competition and rising labor costs.

Conclusion

In September 2025, the US stock market is expected to be influenced by various economic factors. By closely monitoring inflation, interest rates, GDP growth, and sector performance, investors can better position themselves for success. While market volatility is likely to remain a concern, a well-diversified portfolio can help mitigate risk and maximize returns.

can foreigners buy us stocks