Title: Most Popular US Stock Index: A Comprehensive Guide

author:US stockS -

Introduction: In the vast world of financial markets, the United States has a plethora of stock indexes that track the performance of various sectors and companies. However, one particular index stands out as the most popular among investors, traders, and financial analysts. This article delves into the most popular US stock index, its significance, and how it impacts the global market.

The Most Popular US Stock Index: The S&P 500

The S&P 500, also known as the Standard & Poor's 500, is widely regarded as the most popular US stock index. It consists of 500 large-cap companies from various sectors, including technology, healthcare, finance, and consumer goods. The index is designed to represent the performance of the broad U.S. stock market and is considered a benchmark for evaluating the overall health of the economy.

Why is the S&P 500 So Popular?

There are several reasons why the S&P 500 has gained such immense popularity:

Representativeness: The S&P 500 includes companies from various sectors, making it a comprehensive indicator of the U.S. stock market. This diversity allows investors to gain exposure to a wide range of industries without having to invest in multiple stocks.

Market Capitalization: The index comprises large-cap companies, which are generally considered to be more stable and less volatile compared to small-cap or mid-cap stocks. This makes the S&P 500 a preferred choice for conservative investors seeking long-term growth.

Historical Performance: Over the years, the S&P 500 has delivered impressive returns, making it a go-to index for investors looking to achieve capital appreciation.

Ease of Access: The S&P 500 is easily accessible through various investment vehicles, such as exchange-traded funds (ETFs) and mutual funds. This allows investors to gain exposure to the index without the need for extensive research or expertise.

Impact of the S&P 500 on the Global Market

The S&P 500 has a significant impact on the global market due to its popularity and representativeness. Here are a few ways in which it influences the market:

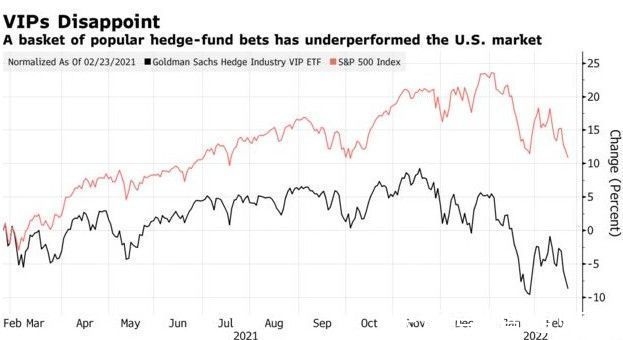

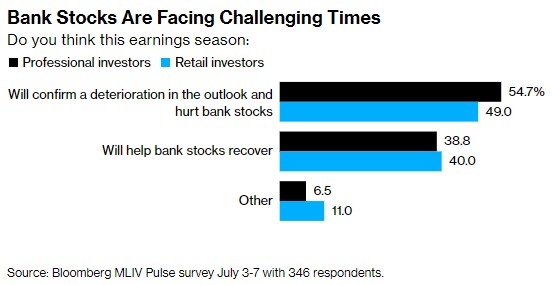

Investor Sentiment: The performance of the S&P 500 often reflects investor sentiment towards the U.S. economy and the stock market. A rising index can boost investor confidence, while a falling index can lead to increased uncertainty.

Economic Indicators: The S&P 500 is closely monitored by economists and policymakers as an economic indicator. Its performance can provide insights into the overall health of the U.S. economy and influence monetary policy decisions.

Global Investment Trends: The S&P 500 serves as a benchmark for global investors, influencing investment trends and portfolio allocations worldwide.

Case Study: The 2008 Financial Crisis

One notable example of the S&P 500's impact on the global market is the 2008 financial crisis. In the months leading up to the crisis, the index experienced a sharp decline, signaling potential trouble in the U.S. economy. This decline triggered a wave of panic across the globe, leading to a global financial meltdown.

Conclusion:

The S&P 500 is the most popular US stock index for a variety of reasons, including its representativeness, historical performance, and ease of access. Its impact on the global market is significant, influencing investor sentiment, economic indicators, and global investment trends. As an investor, understanding the S&P 500 and its role in the market can help you make informed decisions and stay ahead of the curve.

can foreigners buy us stocks