Is the US in a Stock Market Bubble?

author:US stockS -

In recent years, there has been a considerable debate surrounding the stability of the US stock market. Many investors and financial experts are questioning whether the current market conditions are indicative of a bubble. This article delves into this topic, analyzing various factors that might suggest a bubble and those that might indicate a healthy market.

Understanding a Stock Market Bubble

A stock market bubble refers to a situation where the prices of stocks become detached from their intrinsic value. This often occurs when investors are driven by speculative frenzy rather than fundamental analysis. Bubbles are characterized by rapid price increases that are not supported by underlying economic fundamentals, eventually leading to a sudden and dramatic crash.

Factors Indicating a Bubble

Rising Valuations: One of the primary indicators of a bubble is when stock prices significantly exceed their intrinsic value. For instance, the Shiller P/E ratio, which compares the market's price to the average of its earnings over the past 10 years, is currently at an elevated level. This suggests that stock prices might be overvalued.

Excessive Debt: High levels of debt can be a sign of speculative behavior in the stock market. Many companies have taken on substantial debt to finance share buybacks or expand their operations, which can lead to financial instability.

Speculative Trading: The surge in popularity of cryptocurrencies and other speculative assets might indicate a shift in investor behavior. Many individuals are pouring their money into risky investments, possibly driving up stock prices beyond their fundamental worth.

Economic Indicators: Certain economic indicators, such as a rising interest rate or inflation, can be warning signs of an impending bubble. If these indicators suggest a potential economic downturn, it could lead to a market correction.

Factors Indicating a Healthy Market

Robust Economic Growth: A strong and stable economy can provide a solid foundation for a healthy stock market. Low unemployment rates and strong consumer spending are positive signs.

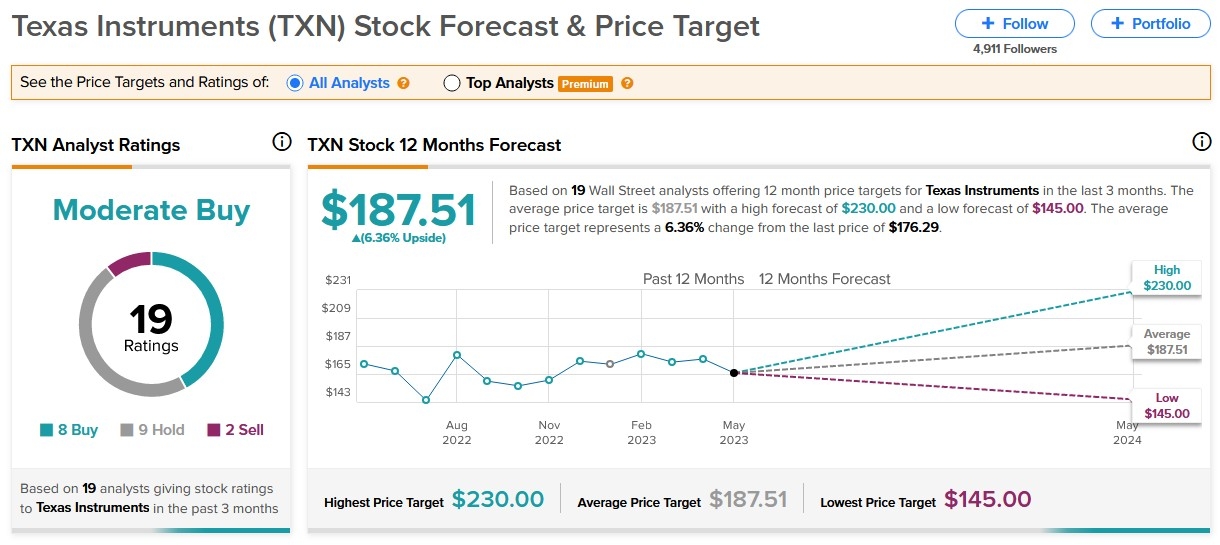

Innovative Companies: The presence of innovative companies that are driving technological advancements and creating new industries can contribute to a healthy stock market. These companies often generate high revenue growth and attract investors.

Diversified Market: A diversified market with a mix of industries and companies can help mitigate the impact of potential bubbles. This allows investors to spread their risk across different sectors.

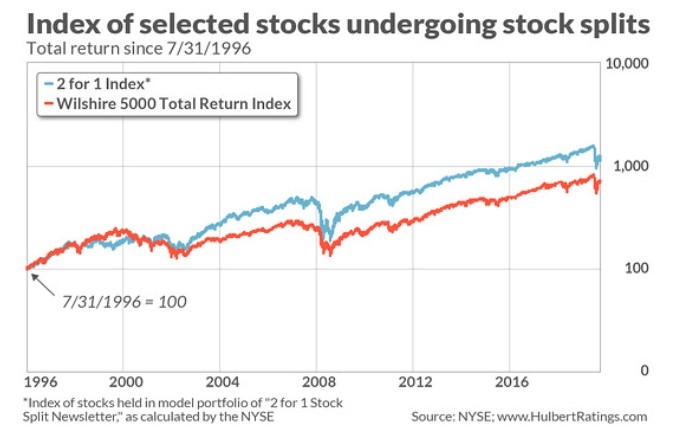

Case Study: The Dot-com Bubble

One of the most famous examples of a stock market bubble is the dot-com bubble of the late 1990s. During this period, the prices of internet-related stocks soared, driven by speculative frenzy. When the bubble burst, the market experienced a significant decline, leading to substantial losses for many investors.

Conclusion

While there are signs that the US stock market might be overvalued, it is essential to consider a range of factors before concluding that it is in a bubble. A healthy economy, innovative companies, and a diversified market can help maintain stability. However, it is crucial for investors to remain cautious and conduct thorough research before making investment decisions.

can foreigners buy us stocks