How to Invest in US Stocks from India with Zerodha

author:US stockS -

Are you looking to diversify your investment portfolio by investing in US stocks from India? If so, you're not alone. Many Indian investors are increasingly looking towards the US stock market for potential growth and returns. One of the most popular platforms for this purpose is Zerodha, a leading online stockbroker in India. In this article, we will guide you through the process of investing in US stocks from India using Zerodha.

Understanding Zerodha

Zerodha is a renowned online stockbroker that offers a wide range of investment services, including equity, derivatives, commodities, and currencies. The platform is known for its user-friendly interface, competitive pricing, and robust research tools. Zerodha has gained a strong reputation among Indian investors for its reliability and customer support.

Why Invest in US Stocks from India?

Investing in US stocks from India offers several advantages:

- Diversification: The US stock market is one of the largest and most diversified markets in the world. By investing in US stocks, you can diversify your portfolio and reduce your exposure to local market risks.

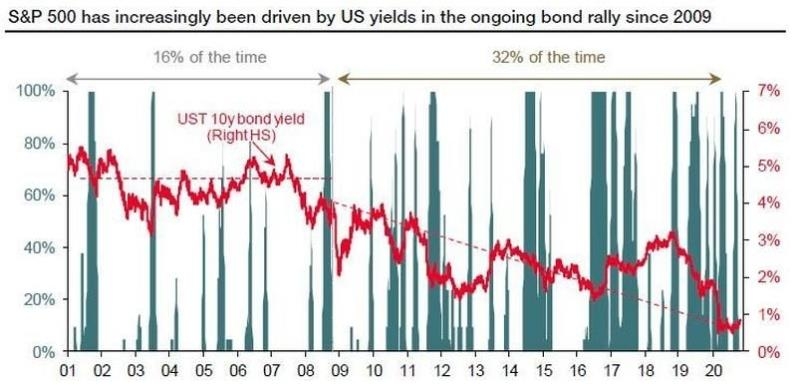

- Potential Growth: The US stock market has historically offered higher returns compared to the Indian market. This makes it an attractive option for investors looking to maximize their returns.

- Global Exposure: Investing in US stocks allows you to gain exposure to global companies and sectors, which can help you stay ahead of the curve.

How to Invest in US Stocks from India with Zerodha

To invest in US stocks from India using Zerodha, follow these steps:

Open a Demat Account with Zerodha: The first step is to open a Demat account with Zerodha. This account will hold your shares and other securities. You can open an account online by visiting the Zerodha website and filling out the necessary forms.

Link Your Bank Account: Once your Demat account is activated, link your bank account to it. This will enable you to transfer funds to your trading account for investment purposes.

Open a Trading Account: After linking your bank account, open a trading account with Zerodha. This account will allow you to buy and sell stocks.

Fund Your Trading Account: Transfer funds from your bank account to your trading account. This can be done through NEFT or RTGS.

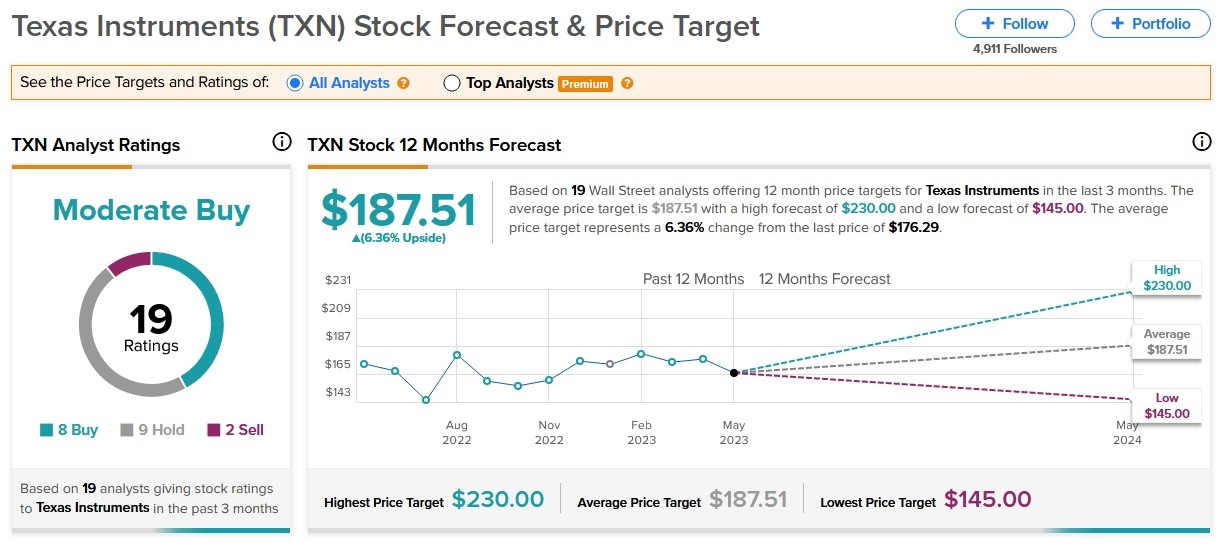

Research and Analyze: Before investing, it's crucial to research and analyze the stocks you're interested in. Zerodha offers a range of research tools and resources to help you make informed decisions.

Place Your Order: Once you've identified the stocks you want to invest in, place your order through the Zerodha platform. You can choose between market orders and limit orders, depending on your investment strategy.

Monitor Your Investments: After placing your order, monitor your investments regularly. Keep track of the stock's performance and make adjustments to your portfolio as needed.

Case Study: Investing in US Stocks with Zerodha

Let's take a look at a hypothetical case study to understand the process better. Imagine you want to invest in Apple Inc. (AAPL) using Zerodha.

- Open a Demat Account: You open a Demat account with Zerodha and link your bank account.

- Open a Trading Account: You open a trading account with Zerodha.

- Fund Your Trading Account: You transfer funds from your bank account to your trading account.

- Research and Analyze: You research and analyze Apple Inc. (AAPL) and determine that it's a good investment.

- Place Your Order: You place a market order to buy 100 shares of AAPL at the current market price.

- Monitor Your Investments: After purchasing the shares, you monitor the stock's performance and make adjustments to your portfolio as needed.

Investing in US stocks from India with Zerodha is a straightforward process that offers numerous benefits. By following the steps outlined in this article, you can successfully diversify your investment portfolio and potentially maximize your returns.

can foreigners buy us stocks