Dow Curve: Understanding the Financial Indicator and Its Impact

author:US stockS -

The Dow curve, a crucial financial indicator, plays a pivotal role in the stock market. It tracks the performance of the Dow Jones Industrial Average (DJIA), which consists of 30 significant companies across various sectors. This article delves into the essence of the Dow curve, its significance, and its impact on the market.

What is the Dow Curve?

The Dow curve is a graphical representation of the DJIA, showcasing the price movements over a specific period. It is a valuable tool for investors and traders as it provides insights into market trends, economic conditions, and potential investment opportunities.

Understanding the Importance of the Dow Curve

Market Trend Analysis: The Dow curve helps investors analyze market trends. An upward trend suggests a strong market, while a downward trend indicates market weakness.

Economic Indicator: The Dow curve serves as a barometer for the overall economic health. It reflects the performance of major companies, which, in turn, represents the broader economy.

Investment Decision-Making: Investors use the Dow curve to make informed decisions. By analyzing the curve, they can identify potential buy or sell opportunities based on market trends and economic indicators.

How the Dow Curve Influences the Market

Sentiment Analysis: The Dow curve plays a crucial role in sentiment analysis. It reflects the mood of investors and traders, which can significantly impact market movements.

Trading Strategies: The Dow curve helps traders develop effective trading strategies. By analyzing the curve, they can identify patterns, trends, and potential reversals.

Market Stability: The Dow curve provides insights into market stability. A stable curve suggests a stable market, while volatility in the curve indicates market instability.

Case Studies: The Impact of the Dow Curve on the Market

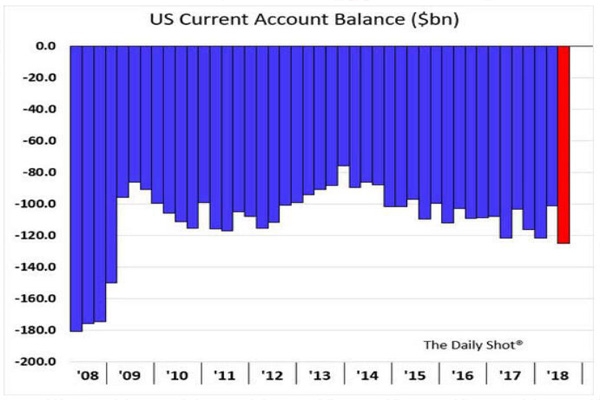

2008 Financial Crisis: During the 2008 financial crisis, the Dow curve plummeted. This decline reflected the market's reaction to the global financial turmoil, leading to widespread panic and sell-offs.

2020 COVID-19 Pandemic: The Dow curve experienced a sharp decline in early 2020 due to the COVID-19 pandemic. However, it recovered quickly as the market adjusted to the new normal.

Conclusion

The Dow curve is a vital financial indicator that provides valuable insights into market trends, economic conditions, and investment opportunities. By understanding the Dow curve, investors and traders can make informed decisions and navigate the complexities of the stock market.

can foreigners buy us stocks