Defense Stock US: A Strategic Investment for the Future

author:US stockS -

In an era where geopolitical tensions are on the rise, investing in defense stocks has become a strategic move for investors looking to safeguard their portfolios. The United States, being a global superpower, has a robust defense sector that offers numerous opportunities for investment. This article delves into the world of defense stocks in the US, highlighting key players, market trends, and potential investment strategies.

Understanding Defense Stocks

Defense stocks refer to shares of companies that are directly or indirectly involved in the defense industry. This includes manufacturers of military equipment, suppliers of defense technologies, and defense contractors. These companies are typically government contractors, providing goods and services to the Department of Defense (DoD) and other government agencies.

Key Players in the Defense Sector

Several companies dominate the defense sector in the US. Here are some of the most notable ones:

- Lockheed Martin Corporation (LMT): As the largest defense contractor in the world, Lockheed Martin is involved in the production of fighter jets, missiles, and satellite systems.

- Raytheon Technologies Corporation (RTX): RTX is a leading provider of defense and commercial aerospace products, including missiles, jet engines, and cybersecurity solutions.

- Boeing Company (BA): Boeing is known for its commercial aircraft, but it also produces military aircraft, such as the F-15 and F/A-18 fighter jets.

- Northrop Grumman Corporation (NOC): Northrop Grumman specializes in aerospace, defense, and technology solutions, including cybersecurity, missile defense, and space systems.

Market Trends and Opportunities

The defense sector in the US is driven by several factors, including:

- Increased Government Spending: The US government has been increasing its defense budget to address global security threats and modernize its military capabilities.

- Technological Advancements: The defense industry is at the forefront of technological innovation, with companies investing in artificial intelligence, robotics, and cybersecurity.

- Geopolitical Tensions: Rising tensions between major powers have led to increased demand for defense equipment and services.

Investors looking to capitalize on these trends should focus on companies that are well-positioned to benefit from these factors. For example, companies involved in cybersecurity and missile defense are likely to see significant growth in the coming years.

Investment Strategies

When investing in defense stocks, it's important to consider the following strategies:

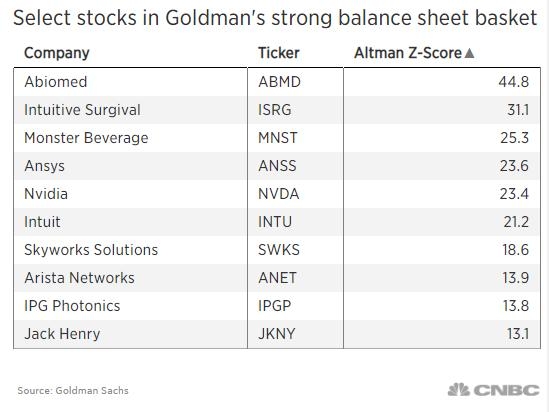

- Diversification: Invest in a mix of defense companies to spread risk and capitalize on different market trends.

- Long-Term Perspective: Defense stocks can be volatile in the short term, but they often offer stable returns over the long term.

- Research and Analysis: Conduct thorough research on individual companies and the overall defense sector to make informed investment decisions.

Case Study: Raytheon Technologies Corporation

One notable example of a successful defense stock is Raytheon Technologies Corporation. Over the past decade, RTX has seen significant growth, driven by its strong position in the defense and commercial aerospace markets. The company's focus on innovation and its ability to adapt to changing market conditions have contributed to its success.

In conclusion, defense stocks in the US offer a unique opportunity for investors looking to diversify their portfolios and capitalize on global security trends. By understanding the key players, market trends, and investment strategies, investors can make informed decisions and potentially benefit from the growth of the defense sector.

can foreigners buy us stocks