Biggest Losers Market Today: Unveiling the Top Decliners

author:US stockS -

In the volatile world of financial markets, today's biggest losers are making headlines. This article delves into the top decliners across various sectors, analyzing the factors contributing to their plummeting stock prices. From tech giants to consumer goods, we'll explore the reasons behind these significant losses and what they mean for investors.

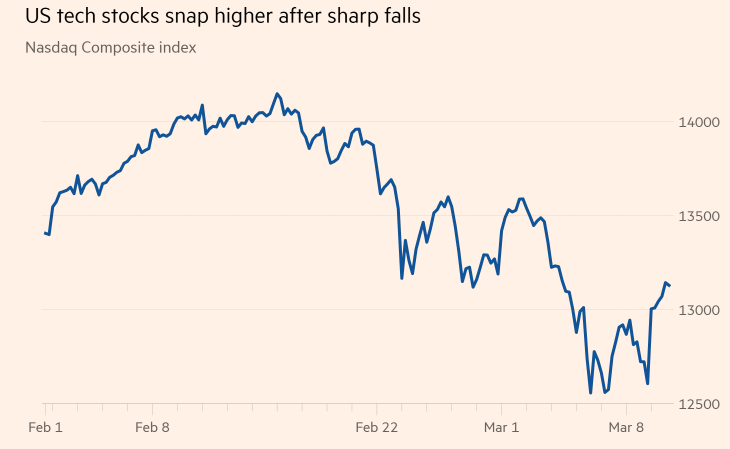

Tech Sector Takes a Hit

The tech sector has been a significant loser today, with several major players witnessing sharp declines. Apple and Amazon lead the pack, experiencing drops of over 3% and 4% respectively. Analysts attribute this to concerns over global supply chain disruptions and increasing competition in key markets.

Consumer Goods Struggles

The consumer goods sector has also faced a tough day, with companies like Procter & Gamble and Coca-Cola seeing their stocks plummet. The primary reason for this decline is the rising costs of raw materials and energy, which are putting pressure on profit margins.

Real Estate Market in Turmoil

The real estate market has been another area of concern, with several real estate investment trusts (REITs) witnessing substantial declines. Vornado Realty Trust and Equity Residential are among the worst performers, with drops of over 5% and 6% respectively. The reasons for this are multifaceted, including rising interest rates and concerns about the future of the housing market.

Energy Sector Under Pressure

The energy sector has also been hit hard, with major oil companies like ExxonMobil and Chevron experiencing declines of over 2%. The primary reason for this is the ongoing decline in oil prices, which is affecting the bottom lines of these companies.

Analyst Insights

Analysts are closely monitoring these declines and offering their insights. Many believe that the current market volatility is a result of several factors, including rising inflation, increasing interest rates, and global supply chain disruptions. They advise investors to stay cautious and diversify their portfolios to mitigate risks.

Case Study: Tesla's Decline

A notable case study is Tesla, which saw its stock drop by over 4% today. Analysts attribute this to concerns over the company's ability to meet its production targets and the rising costs of raw materials. This highlights the importance of staying informed about the latest news and developments in the market.

Conclusion

Today's biggest losers in the market provide valuable insights into the broader economic landscape. By understanding the reasons behind these declines, investors can make more informed decisions and navigate the volatile market more effectively. As always, staying informed and diversified is key to managing risks and achieving long-term success.

can foreigners buy us stocks