Understanding the US Stock Market After Hours Trading

author:US stockS -The(937)Market(476)Stock(1759)

The US stock market is a bustling hub of financial activity, with traders and investors constantly seeking opportunities to capitalize on market movements. One such opportunity arises during the after hours trading period, which takes place outside of regular trading hours. This article delves into the intricacies of after hours trading, its benefits, risks, and how it impacts the broader market.

What is After Hours Trading?

After hours trading refers to the buying and selling of stocks, bonds, and other securities outside of the standard trading hours of the stock exchanges. In the United States, the primary exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ, operate from 9:30 AM to 4:00 PM Eastern Time. However, after hours trading can occur before the market opens at 4:00 PM and after it closes at 9:30 AM the next day.

Benefits of After Hours Trading

One of the primary benefits of after hours trading is the ability to react quickly to market-moving news and events. This can be particularly advantageous for investors who are unable to trade during regular trading hours due to work commitments or other obligations. Here are some key benefits:

- React to News Instantly: Investors can trade immediately after significant news events, such as earnings reports, mergers, or economic data releases.

- Access to More Information: After hours trading provides access to additional information that may not be available during regular trading hours, allowing investors to make more informed decisions.

- Potential for Greater Profits: Investors who are able to trade quickly and effectively during after hours trading can potentially capture larger profits.

Risks of After Hours Trading

While after hours trading offers numerous benefits, it also comes with its own set of risks:

- Lack of Liquidity: The volume of trading during after hours trading is typically lower than during regular trading hours, which can lead to wider bid-ask spreads and less liquidity.

- Volatility: The stock market can be more volatile during after hours trading, as there may be fewer traders actively participating in the market.

- Information Asymmetry: Investors may not have access to the same level of information as professional traders, which can lead to making less informed decisions.

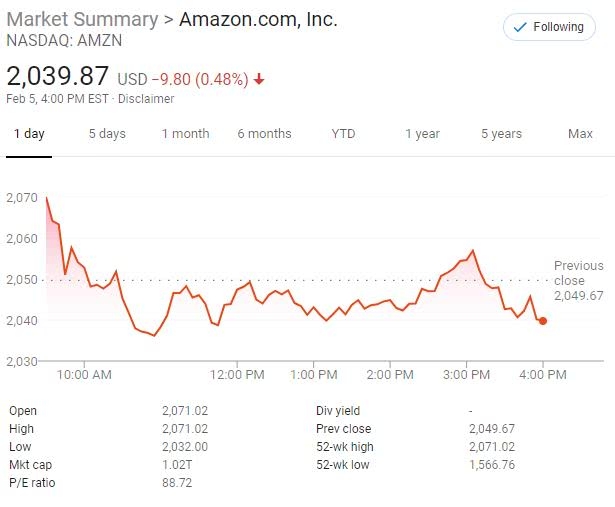

Case Study: After Hours Trading and Earnings Reports

One of the most common scenarios for after hours trading is the release of earnings reports. For example, when a company like Apple Inc. releases its quarterly earnings report, investors can react immediately to the news, often leading to significant price movements. In the case of Apple's earnings report in October 2021, the stock experienced a significant surge after hours, indicating a strong reception to the company's results.

Conclusion

After hours trading can be a valuable tool for investors looking to capitalize on market-moving news and events. However, it is important to understand the risks and benefits associated with this type of trading. By doing so, investors can make more informed decisions and potentially enhance their investment returns.

us stock market today live cha