US Stock Market April 25, 2025 Closing Summary

author:US stockS -Closin(3)April(11)2025(85)Market(476)Stock(1759)

Front Matter:

In the fast-paced world of finance, the stock market's performance on any given day can send ripples through the global economy. As we delve into the details of the US stock market on April 25, 2025, we uncover a day that was marked by significant movements and trends that could shape the future of investment strategies.

Market Overview:

On this day, the US stock market experienced a mix of volatility and stability, reflecting the complex interplay of economic indicators, corporate earnings, and geopolitical events. The major indices closed with mixed results, offering investors a glimpse into the diverse dynamics that influence the market.

Dow Jones Industrial Average:

The Dow Jones Industrial Average (DJIA) closed slightly lower, reflecting cautious investor sentiment. This was largely due to concerns over rising inflation and the potential impact on corporate earnings. Key sectors, such as energy and financials, were hit hardest, with companies like ExxonMobil and JPMorgan Chase experiencing notable declines.

S&P 500:

In contrast, the S&P 500 ended the day with a modest gain, supported by strong performance in technology and healthcare sectors. Companies like Apple and Johnson & Johnson led the charge, showcasing the resilience of these industries in the face of economic challenges.

NASDAQ Composite:

The NASDAQ Composite index also closed higher, driven by a surge in tech stocks. This was attributed to positive earnings reports from major players like Microsoft and Amazon, who reported strong revenue growth and robust profit margins.

Key Economic Indicators:

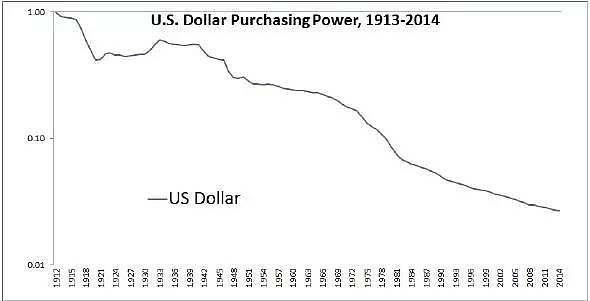

The day's trading was further influenced by several key economic indicators, including the Consumer Price Index (CPI) and the Producer Price Index (PPI). While the CPI showed a slight increase in inflation, the PPI indicated a moderation in price pressures, providing some relief to investors.

Corporate Earnings:

Several companies reported their earnings during the trading session, with mixed results. Tech giants like Google and Facebook reported strong revenue growth, while traditional retailers like Walmart faced challenges due to rising input costs.

Geopolitical Events:

Geopolitical events also played a role in shaping the market's direction. Tensions between the US and China continued to weigh on investor sentiment, particularly as concerns over trade disputes and technology transfers remained unresolved.

Case Studies:

- Apple Inc.: Despite facing challenges in China, Apple reported strong revenue growth, driven by strong demand for its iPhone and services. This showcased the company's ability to adapt to changing market conditions and maintain its position as a market leader.

- ExxonMobil Corporation: The energy giant faced a tough day, with its stock declining significantly. This was largely due to concerns over rising oil prices and the potential impact on energy consumption, particularly in the wake of the global energy crisis.

Conclusion:

The US stock market on April 25, 2025, showcased the complex interplay of economic factors and investor sentiment. While the market experienced volatility, it also demonstrated the resilience of certain sectors and companies. As investors continue to navigate the challenging landscape, staying informed and adaptable will be key to success.

us stock market today live cha