US Steel Stock Price Yahoo: A Comprehensive Analysis

author:US stockS -Yahoo(3)Steel(37)Stock(1759)Price(178)Compre(35)

In the ever-evolving world of financial markets, the stock prices of major companies are constantly under scrutiny. One such company that has garnered significant attention is U.S. Steel Corporation (NYSE: X).

Understanding the Importance of US Steel's Stock Price

The stock price of US Steel, as monitored on Yahoo Finance, is a crucial indicator of the company's financial health and market position. It reflects the company's profitability, growth prospects, and overall performance in the steel industry. This article delves into the factors that influence US Steel's stock price and offers insights into the potential risks and opportunities for investors.

Historical Performance and Market Trends

Historical data shows that the stock price of US Steel has fluctuated significantly over the years. This can be attributed to various factors, including market conditions, steel prices, and company-specific events.

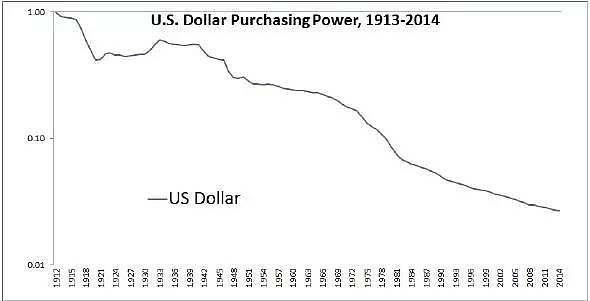

- Market Conditions: Economic downturns or periods of high inflation can negatively impact the steel industry, thereby affecting US Steel's stock price. Conversely, during economic upswings, the demand for steel typically increases, positively impacting the company's financials.

- Steel Prices: As one of the largest steel producers in the United States, the price of steel directly impacts US Steel's revenue and profitability. Fluctuations in steel prices can cause significant volatility in the company's stock price.

- Company-Specific Events: Events such as plant closures, mergers, or acquisitions can also influence US Steel's stock price. For instance, the company's acquisition of AK Steel in 2019 significantly expanded its operations and market share.

Current Market Trends and Factors Affecting Stock Price

As of now, several factors are influencing the stock price of US Steel, as monitored on Yahoo Finance.

- Trade Tensions: Trade disputes between the United States and other countries, such as China, have impacted the steel industry and US Steel's stock price. Tariffs and trade barriers can affect the company's cost of production and its ability to export steel.

- Competition: The steel industry is highly competitive, with numerous players vying for market share. Increased competition can put pressure on US Steel's profitability and stock price.

- Technological Advancements: Continuous technological advancements in steel production can improve efficiency and reduce costs, positively impacting the company's financials.

Case Study: Impact of Tariffs on US Steel

One notable case study involves the impact of tariffs on US Steel. In 2018, the United States imposed tariffs on steel imports, aiming to protect domestic steel producers. While the tariffs initially provided a short-term boost to US Steel's stock price, the long-term impact remains uncertain. The company has faced challenges in adjusting to the new cost structures and increased competition from foreign producers who have been able to maintain lower costs due to lower labor and material costs.

Conclusion

In conclusion, the stock price of US Steel, as monitored on Yahoo Finance, is influenced by a variety of factors, including market conditions, steel prices, and company-specific events. Understanding these factors is crucial for investors looking to make informed decisions regarding their investments in US Steel. As always, it is advisable to conduct thorough research and consult with financial advisors before making any investment decisions.

us stock market today live cha