US Large Cap Stocks Outlook 2025: A Strategic Perspective

author:US stockS -Large(60)Outlook(20)Cap(105)Stocks(1218)2025(85)

In the ever-evolving landscape of the financial market, large cap stocks have always been a cornerstone for investors seeking stability and growth. As we gaze towards 2025, it's crucial to understand the outlook for these blue-chip stocks in the United States. This article delves into the potential trends, risks, and opportunities that may shape the future of large cap stocks in the coming years.

Market Trends and Drivers

1. Economic Stability and Growth

The economic stability and growth of the United States play a pivotal role in shaping the outlook for large cap stocks. With a robust GDP and low inflation, the U.S. economy is expected to remain a beacon of stability in the global market. This favorable economic backdrop is likely to support the growth of large cap stocks in the coming years.

2. Technological Advancements

Technological advancements have been a significant driver of growth for large cap stocks. Companies like Apple, Microsoft, and Google continue to innovate and disrupt various industries, driving their stock prices higher. As we move towards 2025, we can expect these technological giants to maintain their dominance and potentially create new opportunities for investors.

3. Diversification and Risk Management

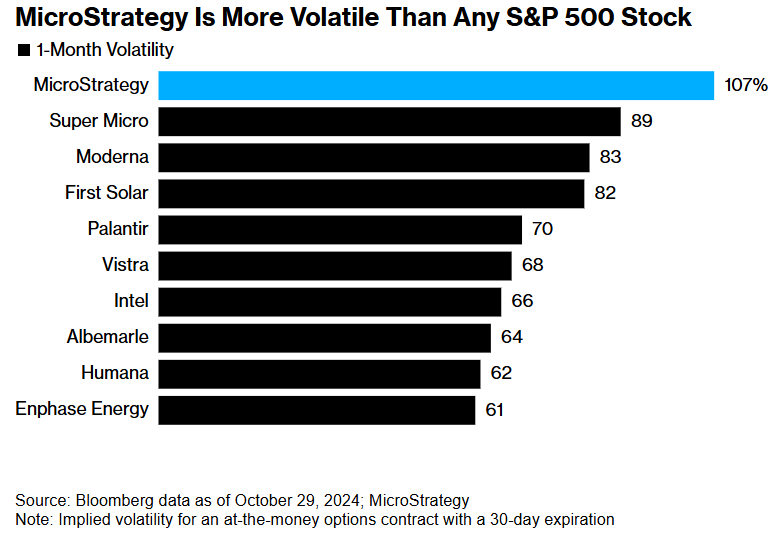

Investors are increasingly focusing on diversification and risk management strategies. Large cap stocks, with their stable earnings and lower volatility, offer a compelling option for investors looking to balance their portfolios. This trend is likely to persist in the coming years, making large cap stocks an attractive investment choice.

4. Regulatory Environment

The regulatory environment plays a crucial role in shaping the outlook for large cap stocks. With the ongoing debate over antitrust laws and data privacy regulations, investors need to stay informed about potential changes that could impact their investments. While regulatory challenges may pose short-term risks, they are unlikely to significantly alter the long-term outlook for large cap stocks.

Case Studies: Apple, Microsoft, and Google

Let's take a closer look at some of the key large cap stocks in the U.S. market:

1. Apple

Apple Inc. has been a dominant force in the technology sector for years. With its innovative products and services, Apple has consistently delivered strong financial results. As we move towards 2025, Apple is expected to continue its growth trajectory, driven by the increasing demand for its products and services in emerging markets.

2. Microsoft

Microsoft Corporation has also been a significant player in the technology sector. With its cloud computing services and enterprise solutions, Microsoft has expanded its revenue streams and diversification. As the demand for cloud computing continues to grow, Microsoft is well-positioned to capitalize on this trend and deliver sustainable growth in the coming years.

3. Google

Google's parent company, Alphabet Inc., has been a leader in the technology sector, offering a wide range of services, including search, advertising, and cloud computing. As the digital advertising market continues to grow, Alphabet is expected to maintain its market leadership and generate substantial revenue.

Conclusion

In conclusion, the outlook for U.S. large cap stocks in 2025 appears promising, driven by economic stability, technological advancements, and diversification strategies. While there are potential risks and challenges, investors can capitalize on the opportunities presented by these blue-chip stocks. As always, it's crucial to conduct thorough research and stay informed about market trends to make informed investment decisions.

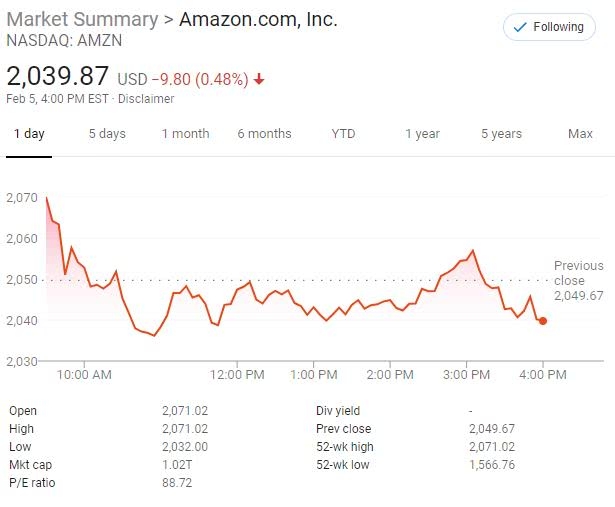

us stock market today live cha