Is the US Stock Market Crashing Today?

author:US stockS -Crashing(2)Toda(3)The(937)Market(476)Stock(1759)

The stock market is a rollercoaster ride that keeps investors on their toes. With its volatile nature, it's not uncommon to find investors asking themselves, "Is the US stock market crashing today?" In this article, we will delve into the factors that can lead to a stock market crash, the current state of the US stock market, and how investors can navigate through these turbulent times.

Understanding the US Stock Market

The US stock market, which includes the New York Stock Exchange (NYSE) and the NASDAQ, is one of the largest and most influential in the world. It's home to numerous companies across various sectors, including technology, healthcare, finance, and more. The stock market is driven by investor sentiment, economic indicators, and geopolitical events.

Factors That Can Lead to a Stock Market Crash

Several factors can contribute to a stock market crash:

Economic Recession: Economic downturns, often marked by high unemployment rates, declining GDP, and rising inflation, can lead to a stock market crash. This is because companies experience reduced revenue, leading to lower profits and falling stock prices.

Geopolitical Events: Events such as wars, political instability, and trade disputes can unsettle investors, causing a sell-off in the stock market.

Interest Rate Changes: Central banks, like the Federal Reserve in the US, adjust interest rates to control inflation and stimulate economic growth. However, sudden changes in interest rates can impact the stock market, as they can affect borrowing costs for companies and consumers.

Technological Advances: Rapid technological advancements can disrupt industries, leading to falling stock prices for companies that fail to adapt.

Current State of the US Stock Market

As of now, the US stock market is experiencing a period of volatility. While some sectors, such as technology and healthcare, have seen strong performance, others, such as energy and financials, have faced challenges. Here are a few key points to consider:

COVID-19 Pandemic: The pandemic has had a significant impact on the stock market, with some sectors experiencing record highs and others facing steep declines.

Inflation Concerns: Rising inflation has raised concerns about the future of the economy and the stock market.

Geopolitical Tensions: Tensions between the US and China, as well as other geopolitical events, have contributed to market volatility.

Navigating Turbulent Times

Investors looking to navigate through turbulent times in the stock market should consider the following strategies:

Diversify Your Portfolio: Diversifying your investments across different sectors and asset classes can help mitigate risk.

Stay Informed: Keep yourself updated with the latest market news and economic indicators.

Avoid Emotional Decisions: Don't let fear or greed drive your investment decisions. Stick to your investment strategy and avoid panic selling.

Consider Alternative Investments: If you're concerned about the stock market, you might want to explore alternative investments, such as bonds, real estate, or commodities.

Case Studies

To illustrate the impact of market crashes, let's consider a few case studies:

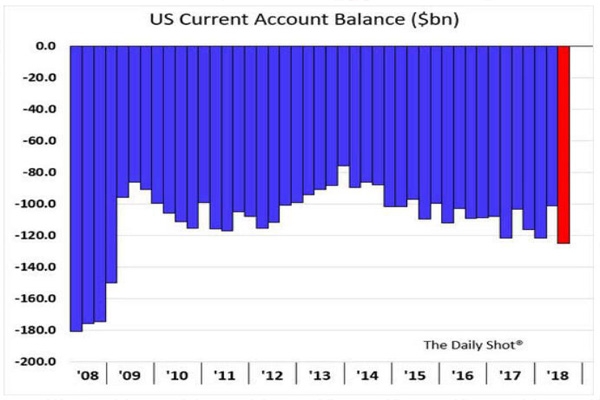

2008 Financial Crisis: The financial crisis of 2008 led to a significant drop in the stock market, with the S&P 500 falling nearly 50% from its peak.

Dot-Com Bubble Burst: The dot-com bubble burst in 2000, causing a steep decline in the stock market, with the NASDAQ losing over 75% of its value.

In conclusion, while the US stock market may be experiencing volatility, it's essential to understand the factors contributing to these fluctuations and how to navigate through them. By staying informed, diversifying your portfolio, and avoiding emotional decisions, you can better position yourself for success in the stock market.

us stock market today live cha