Is Brexit Good for the US Stock Market?

author:US stockS -Brexit(3)Good(18)Mark(15)The(937)for(118)Stock(1759)

Introduction

The United Kingdom's decision to leave the European Union, commonly known as Brexit, has been a topic of debate and speculation. Many investors are questioning whether this historic event will have a positive or negative impact on the US stock market. This article delves into the potential implications of Brexit on the US stock market and analyzes the various factors that could influence its performance.

Understanding the Impact of Brexit on the US Stock Market

Brexit's impact on the US stock market can be understood through various angles. While the outcome is uncertain, some potential effects can be outlined.

1. Currency Fluctuations

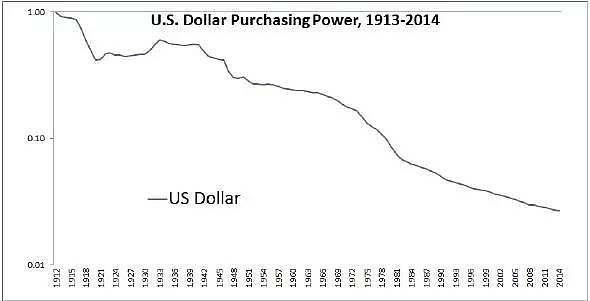

One of the primary concerns post-Brexit has been the volatility in the British pound. The depreciation of the pound has made UK exports cheaper and more competitive, potentially boosting the UK's economic growth. However, this depreciation has also made imports more expensive, which could have a negative impact on UK consumers and businesses. Consequently, the US stock market, which is heavily exposed to international trade, may be affected by these currency fluctuations.

2. Market Uncertainty

Brexit has created a sense of uncertainty in the global market. This uncertainty can lead to cautious investor behavior, causing market volatility. While this volatility can present opportunities for some investors, it can also result in short-term losses for others. Therefore, the impact of Brexit on the US stock market may vary depending on investor sentiment and market conditions.

3. Sector-Specific Impacts

Certain sectors within the US stock market may be more affected by Brexit than others. For instance, the financial sector, which is heavily exposed to international trade and investments, may face challenges due to the uncertainty surrounding Brexit. Conversely, sectors like healthcare and technology may be less affected as they are less dependent on international trade.

4. Long-Term Prospects

While the short-term impact of Brexit on the US stock market is uncertain, the long-term prospects may not be as negative as some believe. The UK's exit from the EU could potentially lead to the emergence of new trade agreements and opportunities. These new agreements may benefit the US stock market in the long run, especially if they result in increased trade and investment.

Case Studies

To better understand the potential impact of Brexit on the US stock market, let's look at a couple of case studies.

Case Study 1: Financial Sector

The financial sector, particularly banks and investment firms, has been heavily exposed to the UK market. Following the Brexit vote, these companies experienced significant market volatility. However, many have since recovered and are now focusing on diversifying their international operations to mitigate future risks.

Case Study 2: Technology Sector

The technology sector has been relatively unaffected by Brexit. Companies in this sector are less exposed to international trade and more focused on innovation and market expansion. As a result, the US stock market has seen continued growth in the technology sector, despite the uncertainty surrounding Brexit.

Conclusion

Brexit has introduced a level of uncertainty in the global market, including the US stock market. While the short-term impact may be negative, the long-term prospects may not be as bleak. Investors should carefully monitor market conditions and consider diversifying their portfolios to mitigate potential risks. As always, it is crucial to conduct thorough research and seek professional advice before making any investment decisions.

us stock market today live cha