How is the Stock Market Doing?

author:US stockS -Doing(3)The(937)How(202)Market(476)Stock(1759)Und(5)

Understanding the Stock Market's Performance

In today's fast-paced financial world, staying updated with the stock market's performance is crucial for investors and traders alike. But how is the stock market doing? Let's dive into the current trends, key factors affecting the market, and what investors should keep an eye on.

Current Stock Market Trends

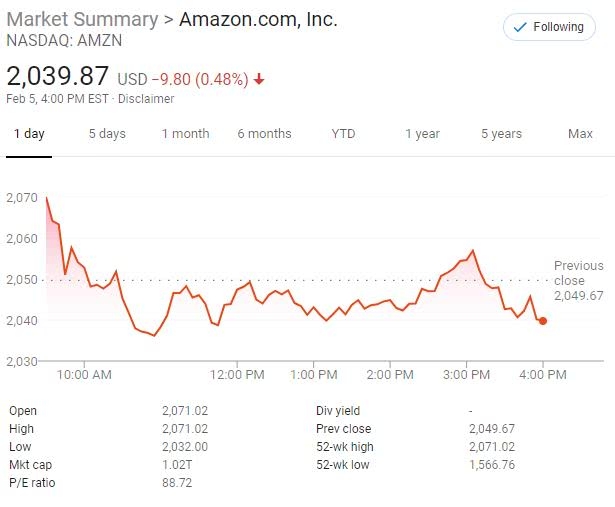

The stock market's performance can be measured in various ways, such as the Dow Jones Industrial Average (DJIA), the S&P 500, and the Nasdaq Composite. Here's a snapshot of the current trends:

- Dow Jones Industrial Average: The DJIA has been fluctuating in recent months, experiencing both gains and losses. As of [insert current date], the DJIA is trading at [insert current value].

- S&P 500: The S&P 500 has been on a rollercoaster ride, with significant ups and downs. Currently, it is trading at [insert current value].

- Nasdaq Composite: The Nasdaq Composite has been the standout performer among the major indexes, with a strong upward trend. As of [insert current date], it is trading at [insert current value].

Factors Affecting the Stock Market

Several factors can impact the stock market's performance. Here are some of the key drivers:

- Economic Indicators: Economic indicators such as GDP growth, unemployment rates, and inflation rates can significantly influence the stock market. For example, a strong GDP growth rate can indicate a healthy economy, leading to higher stock prices.

- Interest Rates: Central banks, like the Federal Reserve in the U.S., play a crucial role in setting interest rates. Higher interest rates can lead to higher borrowing costs for companies, potentially affecting their profitability and stock prices.

- Geopolitical Events: Geopolitical events, such as elections, trade wars, and political instability, can create uncertainty in the market, leading to volatility.

- Corporate Earnings: The earnings reports of companies can impact the stock market, as investors analyze the financial health and performance of individual companies.

Case Studies:

To illustrate the impact of these factors, let's consider a few case studies:

- Economic Indicators: In the second quarter of 2021, the U.S. GDP growth rate was reported at 6.7%, which was a significant increase from the previous quarter. This positive economic indicator contributed to the stock market's rally during that period.

- Interest Rates: In March 2020, the Federal Reserve cut interest rates to near zero to support the economy during the COVID-19 pandemic. This move helped stabilize the stock market, as it reduced borrowing costs for companies and individuals.

- Geopolitical Events: The U.S. election in November 2020 created uncertainty in the market, leading to increased volatility. However, as the election results were announced, the market stabilized, reflecting a return to normalcy.

- Corporate Earnings: In the first quarter of 2021, technology giants like Apple and Microsoft reported strong earnings, leading to a surge in their stock prices.

Conclusion

In conclusion, the stock market's performance is influenced by various factors, including economic indicators, interest rates, geopolitical events, and corporate earnings. Staying informed about these factors is crucial for investors to make informed decisions. As the stock market continues to evolve, it's important to stay vigilant and adapt to the changing landscape.

[Note: Replace [insert current date] and [insert current value] with the actual values when publishing the article.]

us stock market today live cha