Can U.S. Stock Market Bounce Back?

author:US stockS -Bounce(1)Can(100)Market(476)Stock(1759)U.S.(57)B(15)

Introduction:

The U.S. stock market has faced unprecedented challenges in recent years, from global pandemics to political uncertainties. Investors are often left wondering: Can the market bounce back? In this article, we'll explore the factors influencing the stock market's potential recovery and discuss whether a bounce back is possible.

Historical Performance:

Looking at the historical performance of the U.S. stock market, it's clear that resilience has been a hallmark. Even during the Great Recession of 2008, the market managed to bounce back and reach new highs. This resilience can be attributed to various factors, including strong corporate earnings, technological advancements, and a diversified investor base.

Current Market Conditions:

Today, the stock market is facing a mix of challenges, including rising inflation, supply chain disruptions, and geopolitical tensions. However, many experts believe that these challenges are temporary and that the market has the potential to bounce back. Here are some key factors that could contribute to a recovery:

1. Corporate Earnings:

One of the main drivers of stock market performance is corporate earnings. Companies with strong financials are better equipped to navigate through tough times. Many U.S. companies have reported solid earnings in recent quarters, which could pave the way for a market bounce back.

2. Technological Advancements:

The U.S. is a global leader in technology, and this sector has been a significant driver of stock market growth. As companies continue to innovate and expand their operations, the technology sector is likely to contribute to a market bounce back.

3. Diversification:

The U.S. stock market is highly diversified, with a wide range of sectors and industries represented. This diversification helps to mitigate risks and can contribute to a stronger market bounce back.

4. Interest Rates:

Interest rates play a crucial role in the stock market. With the Federal Reserve indicating a gradual increase in interest rates, investors are closely watching how this could impact the market. Historically, a gradual increase in interest rates has not significantly hindered market growth.

Case Study:

Consider the tech sector during the dot-com bubble in the late 1990s. Despite the bubble bursting, the sector managed to bounce back and become one of the most profitable sectors in the stock market. This example highlights the potential for a bounce back, even in the face of significant challenges.

Conclusion:

While it's difficult to predict the future of the stock market, historical performance and current market conditions suggest that a bounce back is possible. As investors, it's important to remain patient and diversified, as these factors can contribute to a stronger market recovery. With a focus on strong corporate earnings, technological advancements, and a diversified portfolio, the U.S. stock market has the potential to bounce back and continue its path of growth.

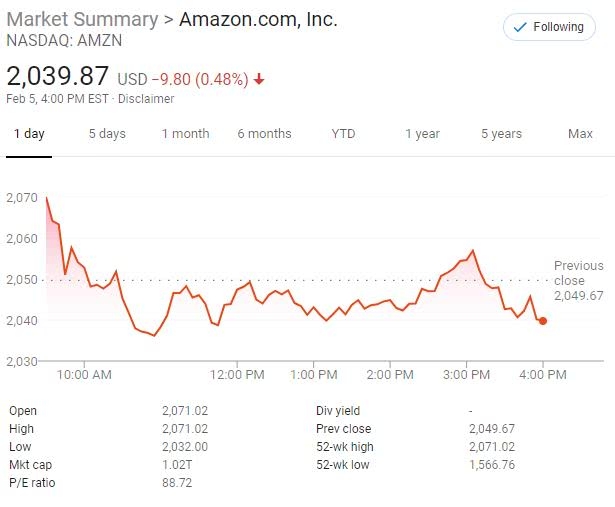

us stock market today live cha