Buy Stocks: Navigating the US Stock Market

author:US stockS -Navigating(14)Stocks(1218)The(937)Buy(216)Stoc(54)

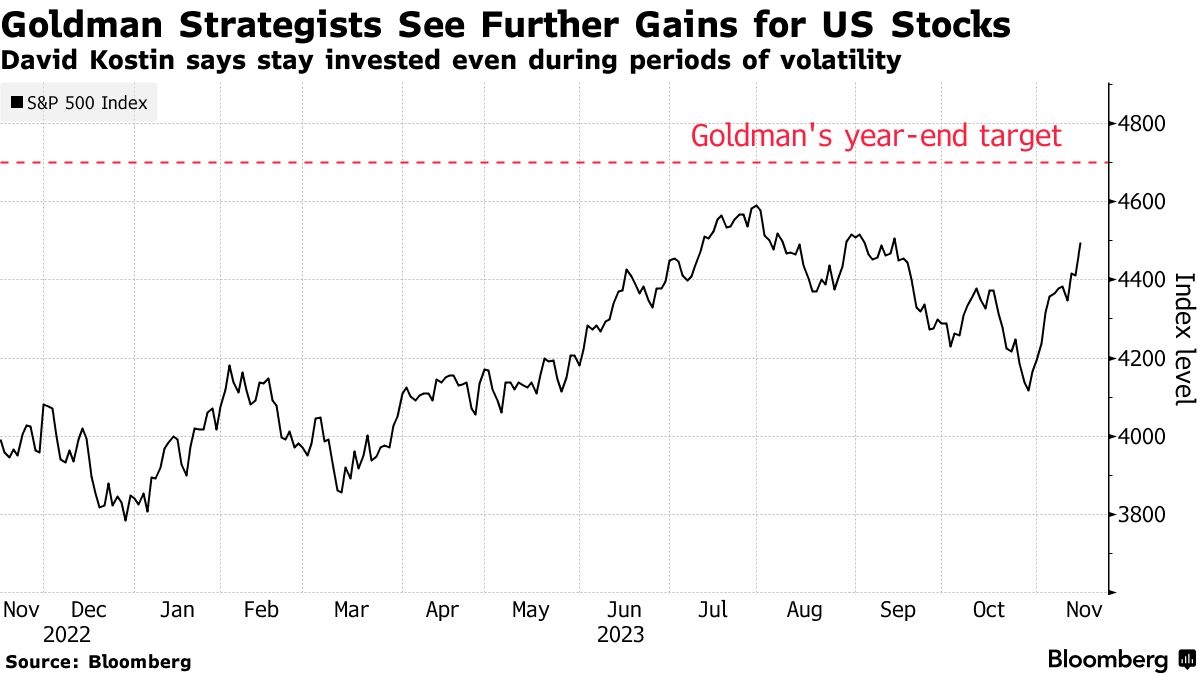

Embarking on the journey to buy stocks in the US stock market can be both exciting and daunting. With numerous investment opportunities available, it's crucial to understand the nuances of the market and the strategies that can help you make informed decisions. This article delves into the basics of buying stocks, the key factors to consider, and some valuable insights to guide you through the process.

Understanding the US Stock Market

The US stock market is one of the most robust and liquid markets in the world. It is home to a diverse range of companies across various sectors, offering investors a wide array of choices. The primary exchanges where stocks are traded include the New York Stock Exchange (NYSE) and the NASDAQ.

Choosing the Right Stocks

When buying stocks, it's essential to research and analyze potential investments thoroughly. Here are some key factors to consider:

- Company Financials: Examine the company's financial statements, including the income statement, balance sheet, and cash flow statement. Look for signs of profitability, revenue growth, and strong management.

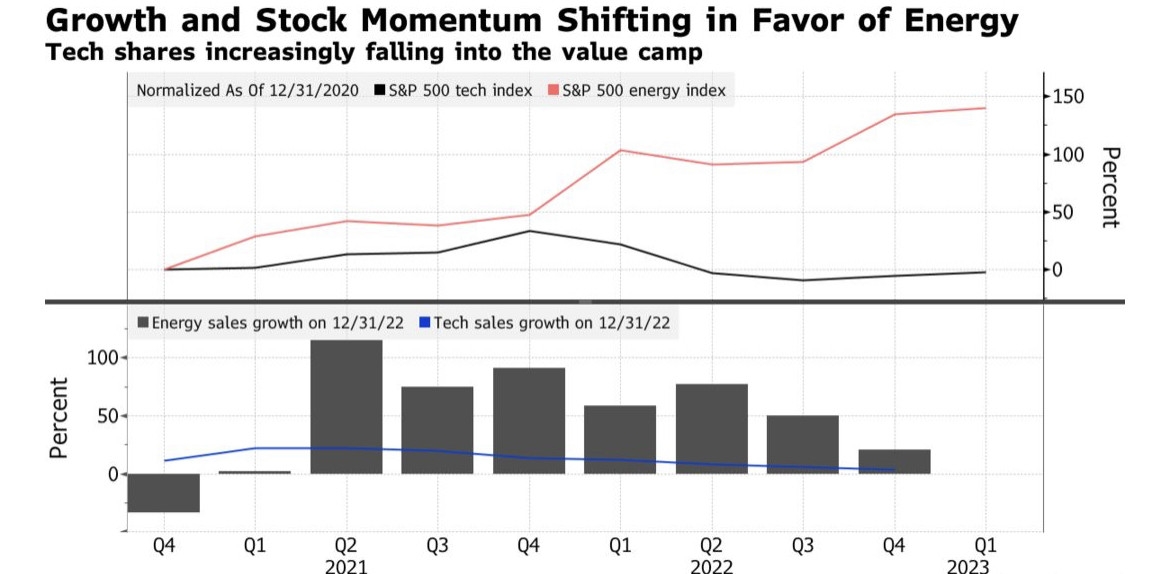

- Sector and Industry Trends: Understand the current trends and outlook for the company's industry. Is it a growing sector with a promising future, or is it facing challenges?

- Market Capitalization: Consider the market capitalization of the company. Large-cap companies are typically more stable, while small-cap companies may offer higher growth potential but with increased risk.

Investment Strategies

There are various investment strategies you can employ when buying stocks in the US stock market:

- Dividend Stocks: These stocks provide investors with regular dividend payments. They are ideal for income-focused investors.

- Growth Stocks: These stocks are expected to grow at a faster rate than the market average. They are suitable for investors seeking long-term capital appreciation.

- Value Stocks: These stocks are undervalued relative to their intrinsic value. They are attractive to investors who believe the market will eventually recognize their true worth.

Case Study: Apple Inc. (AAPL)

A prime example of a successful stock investment is Apple Inc. (AAPL). Since its initial public offering (IPO) in 1980, Apple has grown to become one of the world's most valuable companies. Its innovative products, strong brand, and impressive financial performance have made it a favorite among investors.

By focusing on its core competencies, such as hardware, software, and services, Apple has consistently delivered strong growth and profitability. As a result, its stock has appreciated significantly over the years, making it a compelling investment for long-term investors.

Conclusion

Buying stocks in the US stock market requires thorough research, analysis, and a well-defined investment strategy. By understanding the market, evaluating potential investments, and adopting a disciplined approach, you can increase your chances of success. Remember to stay informed, manage your risk, and be patient as you navigate the dynamic world of stock investing.

can foreigners buy us stocks